Singapore Real Estate Cycle

Housing supply has always been tight in Singapore, the world’s most densely populated country. With 5,500,000 inhabitants lived in an area of 700 square kilometer or approximately 7,800 people per square kilometer.

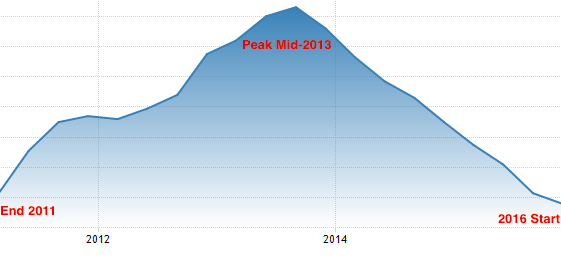

2014: For the first time in many years, it changed from shortage of homes to a surplus of 4,000 homes. And will increase the surplus to 21,000 by end 2015. The surplus would further extend to 70,000 surplus units by end 2017. The surplus trend then starts reversing slowly.

Assuming there is no new housing development projects and no citizenship ram-up, this surplus housing units would take at least 3-years (till 2020) to be occupied.

2013: As more home were completed in 2013, the overall shortage (backlog) has reduced to 19,000.

2012: 14,000 new private home completed in 2012. This is below the demand for physical homes of about 25,000 per year. So there is an accumulative housing shortage (backlog).

As of end 2011, private property prices are 13% above the 1996 peak and 16% above the more recent 2008 peak.

2011 January: Government announced measures to deter property flipping with the extension of the holding period for imposition of SSD on residential properties from 3 years to 4 years based on new rates. The new SSD rates will be imposed on residential properties which are acquired (or purchased) on or after 14 January 2011 and disposed of (or sold) within 4 years of acquisition, as follows : Holding period of 1 year : 16% of price to 4% if held for 4 years; Properties acquired before 20 Feb 2010 will not be subject to SSD.

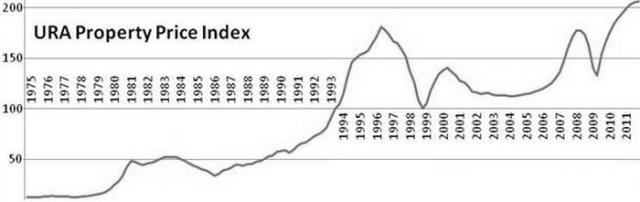

2010 to 2011 prices rebounded and within 2 years the private property index gone up 60%

In 2009. Towards the end of 2008 saw private homes fell off a cliff and continue till end of 2009. Values dived 20% from the year earlier.

In 2008. The index peaked at 175. September 2008, Lehmen Brothers (bank)collapsedand trigger a worldwide financial crisis.

2004 to 2008 Singapore Government tighten the supply of new housing and started to relaxed restriction to home buyer. Immigration policies was also relaxed. Singapore has new cabinet with Mr. Mah Bow Tan at Ministry of National Development (less new housing), Dr. Ng Eng Hen at Ministry of Manpower (more PR and FT) and Mr. Wong Kan Seng at Minstry of Home Affairs (more new citizens).

In 2003. Saw the outbreak of SARS in the region and the Gulf War in Afganhistan and Iraq.

In 2002 October, Singapore in recession.

2000 to 2001 recession affected the European Union. Inflation struck the Eurozone for a few months in summer 2001 but the economy deflated within months. Collapse of the 2001 dot Com bubble and the September 11 Attack. Singapore Government annouced ramming up the construction of 8,000 flats may also have contributed to downward slide.

In 2000. The index peaked at 140.

1996 to 1998 the prices of properties drop by half. The property crash occurs when the government tried to stem this bubble by introducing more land sales to increase the supply. The 1997 Asian Financial Crisis acting as the catalyst, the housing bubble burst and the property market crashed.

In 1996. The index peaked at 180. The Singapore property market began to overheat. New HDB EC projects were launch and they were 10 times over-subscribed.

1986 to 1996 property rises climbed 6 folds. Everyone seems to jump into this bandwagon by flipping properties - 3rm HDB > 5rm HDB > Condo > Terraces > Bungalow. In 1989, the government allow PR to buy HDB homes. The 1990 Gulf War saw a small dip in the property price.

1984 to 1986 world economic reccession hit Singapore. Property price dropped by 30%.

In 1981. The index peaked at 50.

1976 to 1981 property prices shot up 4 times. A 3-room HDB apartment purchased for $10k in 1970s is worth $40k by 1980s.

In 1976. The government allowed foreigners to purchase flats in building of 6 levels or higher.

In 1974. The worldwide oil crisis in United States caused property price to fall back to the level of 1972.

In 1972. Property prices spiked up sharply as forigners began to snap up properties.

1960 to 1970. 12,000 HDB 3-room (600 sq. ft.) apartments were built.

In 1960. HDB formed to provide subsidised, mass market apartment housing to citizens

---

1997 Asian Financial Crisis began in July 1997. The crisis started in Thailand with the financial collapse of the Thai baht caused by the decision of the Thai government to float the baht. At the time, Thailand had acquired a burden of foreign debt that made the country effectively bankrupt even before the collapse of its currency. The crisis spread, most of Southeast Asia and Japan saw slumping currencies, devalued stock markets. Indonesia, South Korea and Thailand were the countries most affected by the crisis. Hong Kong, Malaysia, Laos and the Philippines were also hurt by the slump. The People’s Republic of China, Pakistan, India, Taiwan, Singapore, Brunei and Vietnam were less affected.

Updated On: 16.02.23